Advertisement

Pat Foran, CTV News Toronto Consumer Alert Videojournalist

@PatForanCTVNews

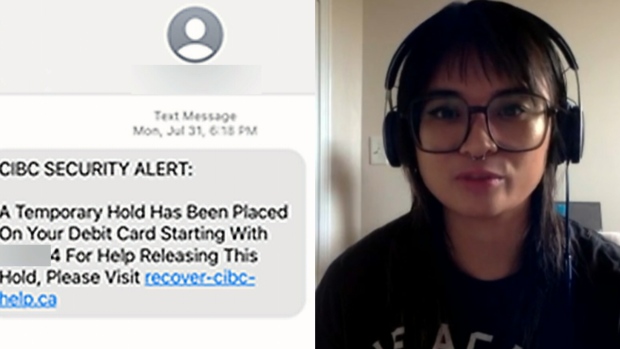

An Ontario university student lost $3,000 after clicking on a link that appeared to be a notice from CIBC to check her online banking.

Toronto student Elisha Manila said she clicked on a link in a text she received and thought it was taking her to her online bank account.

“They redirected me to a website that looked identical to CIBC’s online banking platform," said Manila.

But after she signed in, scammers were able to hack into her bank account and send themselves an e-transfer of $3,000.

"Next thing you know, one or two hours later I get an email from CIBC saying I successfully e-transferred these people $3,000,” said Manila, adding, “I was dumbfounded. I didn’t think I would fall victim to one of these things."

For the past 20 years, October has been recognized as cyber security awareness month to educate the public on the dangers of online scams.

CTV News Toronto reached out to CIBC and a spokesperson said in a statement, “ We worked with our client to resolve this matter given the unique and extenuating circumstances involved. It is important to remember that impersonation scams are on the rise and can affect anyone.”

“We will never ask a client in a text or email message to click a link to confirm personal information, complete a transaction or resolve a security issue.”

“Clients have a role to play in recognizing scams and protecting themselves against them, including keeping personal or banking information safe and secure, and not sharing it with anyone. If you’re suspicious, contact your bank using the official phone number found on the back of your card or the website.”

Cybersecurity experts say there has been a 35 per cent increase in targeted attacks. Greg Young, vice president of Cybersecurity with Trend Micro, said, “if you’re not expecting money from a source, it’s probably not real."

"They are going to get you to execute something, to react to something or click on something you normally wouldn’t do, in order to capture your computer to get you to pay a ransom or get into your online banking," said Young.

To avoid so-called smishing (SMS messaging) and phishing (email) scams, CIBC said don’t click on links from suspicious emails and text messages. When logging into online banking, ensure the URL address is correct and never share a one-time verification code.

After CTV News Toronto got involved, CIBC took another look at Manila’s case and returned the $3,000 she lost to the scam.

Young said you should ignore emails and texts when you don’t know the sender and don’t click on attachments or links. Also get in the habit of being more suspicious because if you have a phone or a computer you will get scam messages.

Advertisement

You are now being redirected to the BCE.ca website (Bell Canada Enterprises), where you can view our Accessibility plan, and submit your feedback using our Accessibility webform.

Use of this Website assumes acceptance of Terms & Conditions and Privacy Policy

© 2023  All rights reserved.

All rights reserved.