Fair Lending Strategies – Marketplace Assessments – Peer Lending & Appraisal Gap Analyses

Unlock the potential of your financial institution’s digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Read More about Are You Ready for a Digital Transformation?

How can you optimize your landing pages for success? The answer lies in harnessing AI-led solutions to deliver seamless, personalized user experiences.

Read More about Landing Page Success: Leveraging Advanced Analytics and AI Tools

Services that scale with you.

Read More about Fractional Marketing for Financial Brands

By Jim Marous, Co-Publisher of The Financial Brand, CEO of the Digital Banking Report, and host of the Banking Transformed podcast

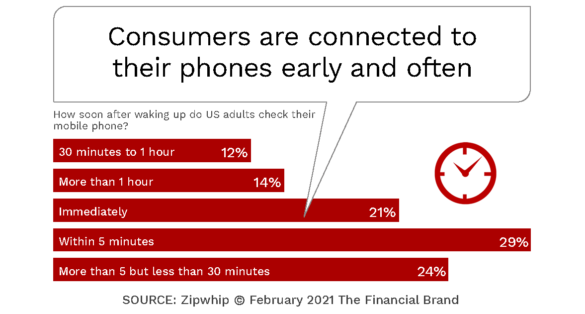

Think about how you use your own mobile device. When do you first look at it during the day? What messages do you check first? Which messages are you most likely to respond to? For most people, the mobile phone is looked at within minutes of waking up in the morning and text messages are viewed before any email is opened.

When it comes to direct marketing, no channel is more immediate or impactful than SMS marketing. 68% of people say checking, sending, and answering text messages is the activity that they’re most engaged with on their phones throughout the day. In addition, 82% of consumers say they open every text message they receive.

Since the pandemic, more and more firms have leveraged SMS marketing to communicate with receptive customers. With much higher and faster open rates than email, SMS marketing is an extremely effective way to reach a massive audience of consumers with important messages.

Research has shown that it takes 90 seconds for someone to respond to a text message compared to the 90 minutes or more that it takes for someone to respond to email. Since most consumers carry their phones at all times, SMS is a highly reliable way to reach your target audience. And, while text messages can’t have the depth of other forms of communication, the simplicity of linking content and compatibility with all brands of mobile devices are why text messages have become so popular.

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Now more than ever, consumers expect the brands they use to communicate on a personalized level, in real time. There is no communication platform that is as direct and agile as an SMS message. But, while over 65% of the world regularly uses text messaging, only about 40% of marketers use SMS texting. The delay in adoption by marketers is a combination of the lack of familiarity with how to maximize the channel’s effectiveness and concerns around the perceived intrusiveness of the channel.

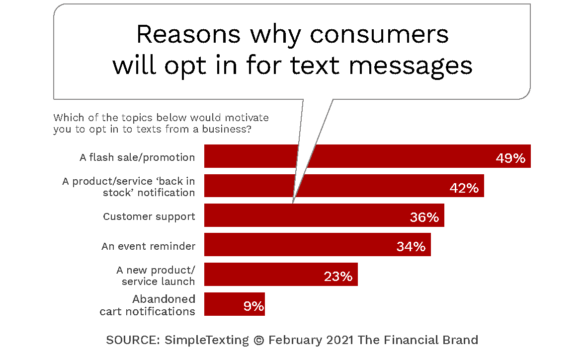

As email inboxes and social media feeds become cluttered with direct-to-consumer brands urging people to buy something, brands are in search of new places to talk to customers where they aren’t yet sick of hearing from brands. In fact, more than 75% of consumers say they prefer to receive promotions via text messages than seeing ads while browsing the internet and social media channels. By giving consumers the choice to opt in or opt out, you’re giving them control of the messages they see, instead of interrupting their social browsing.

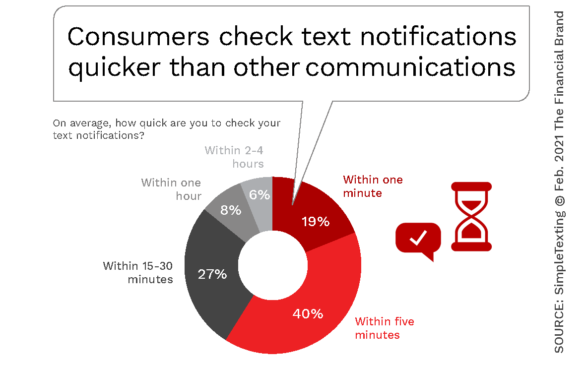

According to the 2020 Text Messaging Marketing Report from SimpleTexting, 42% of Millennials check their text messages 10 or more times per day on average. When asked, “How quick are you to check your text notifications throughout the day,” almost 60% of all consumers surveyed stated that they checked within one to five minutes of the text coming through. In fact, 68% of respondents said that checking, sending and answering text messages is the activity that they’re most engaged with on their phones throughout the day, followed by:

Similar to all communication options, consumers have preferences about the types of information they want to receive via text, how often they want to receive texts from businesses, and other preferences. For instance, when it comes to SMS marketing, consumers are most receptive to texts regarding shipment tracking (75%), order confirmation (65%), scheduling reminders (46%), and special offers (35%). In addition, the majority of respondents (60.8%) would like the capability to text businesses back about customer support issues.

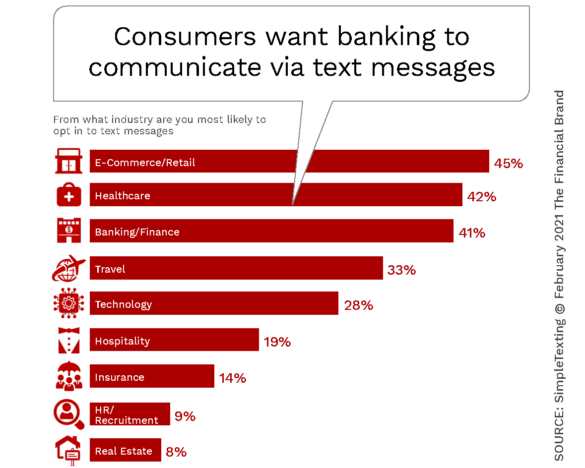

When it comes to who consumers want to receive text messages from the top three industries customers say they are more likely to opt into text messages are: e-commerce/retail industry (46%), healthcare (43%), and banking or financial institutions (41%). Businesses see 98% open rates and 36% click-through rates for special offers because consumers enjoy when good deals come to them directly through text, rather than sifting through websites, emails, and social media.

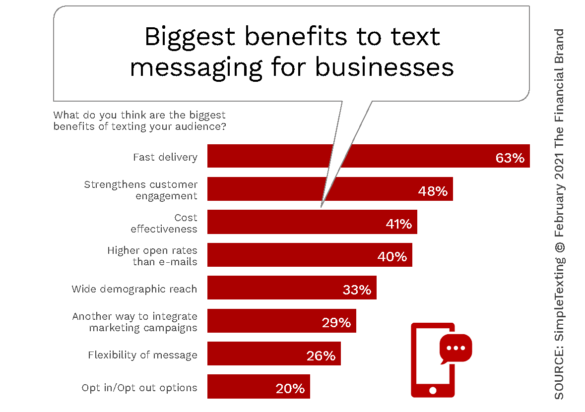

When asked about the advantages of SMS texting, over 62% of business owners and marketers surveyed stated that fast delivery of messages was the biggest benefit of texting their audience, followed by strengthened customer engagement and cost-effectiveness. With consumers having their phone in hand almost every waking moment, the speed of message delivery and engagement for SMS text messages is hard to beat. Text marketing is also very cost-effective in comparison to other forms of digital marketing and advertising.

When businesses were asked about the primary motivation for using SMS texting, over 52% of businesses stated that having a large mobile audience was their primary motivator for investing in text marketing, followed by the ability for strong customer engagement, real time reach, and high open rates.

If you’re trying to recommend a new service, activate a dormant account or provide guidance at a time of potential need, communicating on the mobile channel will be one of the most effective options. SMS marketing is a low-cost, high-return marketing process that can deliver short messages or multimedia content to customers.

Below are some of the most effective SMS tactics used to boost engagement and response rates.

1. Get Permission. Before texting your customers, you need to their permission – by law. Asking for permission provides an opportunity to discuss the way text messaging will be used in the future and gives a very easy way to opt in or opt out. This simple process will increase engagement going forward.

2. Send Time-Sensitive Messages. SMS messages can be perfectly timed based on consumer behavior. From a welcome message after opening a new account to an engagement or special offer message to help a customer use a product or service more effectively, SMS is an ideal marketing channel for communications that need to be opened and acted upon quickly.

3. Integrate with Other Channels. With only a 160-character limit, you can get more out of a campaign if you leverage other channels in addition to SMS. For instance, you can send personalized videos, pictures and links to your web page within a text and supplement SMS messages with email, mobile banking messages and even phone outreach.

4. Personalize SMS Messages. As with any outbound marketing, customers respond best to messages addressed directly to them. With text marketing, you can tailor your message to each recipient according to the data gathered from customer intelligence.

5. Reference Locations. Location-based text campaigns are a method of personalization as well as an effective way to initiate action and engagement. This type of communication can drive them to a local branch or provide them an offer from a local business.

6. Measure Effectiveness. SMS marketing offers a direct, measurable, and trackable marketing channel. You can easily determine which messages and promotions are working and which ones aren’t, allowing you to refine and enhance your text campaigns. Of greatest importance, you can capture leads and text-based responses for sales follow-up.

SMS messaging has become one of the most effective ways for large and small financial institutions to connect with customers and prospects in a very personalized and immediate manner. As more consumers are opting for digital channels, the use of SMS messaging is definitely on the rise. With the success of these campaigns being stronger than any other existing channel, firms are finding new and exciting ways to integrate into their marketing plans.![]() By Jim Marous is co-publisher of The Financial Brand, host of the Banking Transformed podcast and owner/CEO of the Digital Banking Report, a subscription-based publication that provides deep insights into the digitization of banking, with over 200 reports in the digital archive available to subscribers. You can follow Jim on Twitter and LinkedIn.

By Jim Marous is co-publisher of The Financial Brand, host of the Banking Transformed podcast and owner/CEO of the Digital Banking Report, a subscription-based publication that provides deep insights into the digitization of banking, with over 200 reports in the digital archive available to subscribers. You can follow Jim on Twitter and LinkedIn.

This article was originally published on . All content © 2024 by The Financial Brand and may not be reproduced by any means without permission.

The Forum 2024 kicks off May 20th, and the Final Discount ends this Thursday! Hurry, before time runs out!

Read More about Don't miss The Financial Brand Forum and your last chance to save!

This webinar with Jim Marous and David Feuer, CPO of Galileo Financial Technologies will show real-world examples of how banks took a phased approach to start their digital journey.

Read More about How Modern is Your Core? How FIs Can Start Their Digitization Journey

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

May 20-22, 2024 | ARIA HOTEL & RESORT | LAS VEGAS

Don’t miss the financial industry’s premier annual event — the biggest and best conference on CX, marketing, AI, data analytics and digital growth strategies in the banking world!

Get the latest banking news!

Subscribe to our free newseltter and be the first to receive the latest news, trends, and updates — straight to your inbox!

THE FINANCIAL BRAND

The Financial Brand is your premier destination for comprehensive insights in the financial services sector. With our in-depth articles, webinars,, reports and research, we keep banking executives up-to-date with the latest trends, growth strategies, and technological advancements that are transforming the industry today.

RESOURCES

The Untapped Power of SMS Marketing in Banking – The Financial Brand