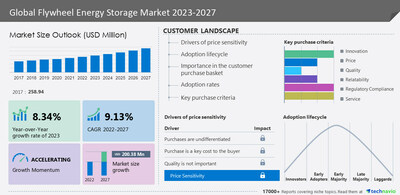

NEW YORK, Sept. 6, 2023 /PRNewswire/ — The flywheel energy storage market is estimated to grow at a CAGR of 9.13% between 2022 and 2027. The market size is forecast to increase by USD 200.38 million. The market is fragmented due to the presence of diversified international and regional companies. The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Competitors have to focus on differentiating their product offerings with unique value propositions to strengthen their foothold in the market. Market companies also have to leverage the existing growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments. Active Power Solutions Ltd., Amber Kinetics Inc., Beacon Power LLC, Calnetix Technologies LLC, ENERGIESTRO, FREQCON GmbH, Langley Holdings Plc, Omnes Energy, Oxto Ltd., POWERTHRU, PUNCH Flybrid, Revterra, Rotonix USA Inc., Schneider Electric SE, Schwungrad Energie, Siemens AG, Stantec Inc., STORNETIC GmbH, The Boeing Co., and VYCON Inc. are among some of the major market participants.The report offers an up-to-date analysis regarding the current market scenario, the latest trends and drivers, and the overall market environment. Request FREE sample report

Company Offering

Active Power Solutions Ltd.- The company offers flywheel energy storage systems such as Cleansource Plus SMS, Cleansource Plus MMS, and Cleansource Plus UPS.

Calnetix Technologies LLC – The company offers flywheel energy storage systems for UPS and runtime requirements.

Amber Kinetics Inc. – The company offers flywheel energy storage systems for ancillary services, energy arbitrage, and energy firming.

Growth in the data center construction market is a key factor driving market growth. The growing demand for cloud services and the need for digitization are driving the growth of data centers globally. Developed countries such as the US and the UK are experiencing significant expansion. Google, Microsoft, AWS, and CSP are expanding through large-scale installations. Colocation and telecommunications service providers contribute to this. The use of multiple inverters is leading to an increase in the use of flywheel ESS for load balancing due to their maintenance advantages over battery-powered inverters. Hence, these factors are expected to drive market growth during the forecast period.

What's New?

Special coverage on the Russia–Ukraine war; global inflation; recovery analysis from COVID-19; supply chain disruptions, global trade tensions; and risk of recession

Global competitiveness and key competitor positions

Market presence across multiple geographical footprints – Strong/Active/Niche/Trivial – buy the report!

Major Trend- Growth in the advanced energy storage market is a major trend in the market.

Significant Challenge- The growing adoption of lithium-ion batteries in UPS systems is a significant challenge restricting market growth. For more details understanding of Market Dynamics download FREE Sample reports

Flywheel Energy Storage Market 2023-2027: Segmentation

The Flywheel Energy Storage Market is segmented as below:

Type

Technology

Geography

The market share growth by the composite rims segment will be significant during the forecast period. The composite rim represents an important variation of the flywheel's ability to store energy, which is typically made from durable yet lightweight carbon fiber composites. Built for strength, these rims facilitate high rotational speeds and efficient energy retention. The use of composite materials offers advantages such as increased performance, rapid responsiveness, and minimal maintenance requirements in flywheel energy storage systems. Hence, these factors are expected to drive segment growth during the forecast period. For insights on global, regional, and country-level parameters with growth opportunities, historic (2017 to 2021) & forecast (2023-2027) – Download a FREE Sample Report

Flywheel Energy Storage Market 2023-2027: Key Highlights

CAGR of the market during the forecast period 2023-2027

Detailed information on factors that will assist flywheel energy storage market growth during the next five years

Estimation of the flywheel energy storage market size and its contribution to the parent market

Predictions on upcoming trends and changes in consumer behavior

The growth of the flywheel energy storage market

Analysis of the market's competitive landscape and detailed information on companies

Comprehensive details of factors that will challenge the growth of the flywheel energy storage market, companies. Gain instant access to 17,000+ market research reports. Technavio's SUBSCRIPTION platform

Related Reports

The advanced energy storage systems (AESS) market is estimated to grow at a CAGR of 8.52% between 2022 and 2027. The market size is forecast to increase by USD 6,703.96 million.

The flow battery market is estimated to grow at a CAGR of 22.16% between 2022 and 2027.

Flywheel Energy Storage Market Scope

Report Coverage

Details

Base year

2022

Historic period

2017-2021

Forecast period

2023-2027

Growth momentum & CAGR

Accelerate at a CAGR of 9.13%

Market growth 2023-2027

USD 200.38 million

Market structure

Fragmented

YoY growth 2022-2023(%)

8.34

Regional analysis

North America, Europe, APAC, Middle East and Africa, and South America

Performing market contribution

North America at 30%

Key countries

US, Canada, China, UK, and Germany

Competitive landscape

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks

Key companies profiled

Active Power Solutions Ltd., Amber Kinetics Inc., Beacon Power LLC, Calnetix Technologies LLC, ENERGIESTRO, FREQCON GmbH, Langley Holdings Plc, Omnes Energy, Oxto Ltd., POWERTHRU, PUNCH Flybrid, Revterra, Rotonix USA Inc., Schneider Electric SE, Schwungrad Energie, Siemens AG, Stantec Inc., STORNETIC GmbH, The Boeing Co., and VYCON Inc.

Market dynamics

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period.

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

Table of Contents

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation by Technology

7 Market Segmentation by Type

8 Customer Landscape

9 Geographic Landscape

10 Drivers, Challenges, and Trends

11 Company Landscape

12 Company Analysis

13 Appendix

About US

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/flywheel-energy-storage-market-to-grow-by-usd-200-38-million-from-2022-to-2027–growth-opportunities-led-by-active-power-solutions-ltd-and-amber-kinetics-inc—technavio-301919277.html

SOURCE Technavio

If you think Apple has a big "China problem" — you'll be shocked to know it's tiny compared with some other S&P 500 companies.

Dividend investing has always been popular, and for good reason. Dividend stocks offer a wide range of advantages for return-minded investors, but two of the most significant are a reliable income stream and an inflation-beating yield. Taken together, these advantages can form the base of a truly sound portfolio. The majority of dividend stocks pay out on a quarterly basis, but turning towards those with a monthly payment schedule allows investors to better plan their income streams to meet thei

Warren Buffett's right-hand man trusted an outsider with his personal wealth and made "four or five times" his money thanks to stock picks like BYD.

These 3 CEOs have put their money where their mouths are, recently stepping up and acquiring shares. Given their confidence, should investors follow them into their trades?

T-Mobile CEO Mike Sievert came out swinging against rivals AT&T and Verizon as the company joins them in offering a dividend.

Since early last year, for some 18 months now, the Federal Reserve has increased interest rates from near-zero to more than 5.5%. The move has tightened access to both capital and credit, effectively reducing the money supply – the classic response to persistent high inflation. Their efforts have borne some fruit, as the pace of inflation has slowed, in just over a year, from over 9% annually to 3.2% in the most recent data. The dramatic shift from more than a decade of loose money and low rates

Saving $1 million (or more) for retirement is a great goal to have. Putting that much aside could make it easier to live your preferred lifestyle when you retire, without having to worry about running short of money. However, not … Continue reading → The post What Percentage of Retirees Have a Million Dollars? appeared first on SmartAsset Blog.

In a sector bursting with bargains, Avista—down more than 25% this year—is particularly cheap. It trades for about 13.7 times earnings, its lowest multiple in more than 10 years.

Transocean (RIG) closed the most recent trading day at $8.08, moving -1.34% from the previous trading session.

The Dow Jones Industrial Average dropped Thursday after initial unemployment claims. Apple stock dived on an expanded China ban.

The general public does not know this yet, but there is no longer any doubt that a Bitcoin spot ETF will come to the US market, writes Charlie McGlynn of XREX. It's just a matter of when.

Oracle's (ORCL) fiscal first-quarter 2024 performance is expected to have benefited from the continued momentum in its cloud infrastructure services.

Shares of the Vietnamese EV start-up VinFast Auto plunged again, but without any particular news to explain the move. VinFast (ticker: VFS) stock closed down almost 27% Thursday, at just below $18 a share, while the and were off 0.3% and 0.9%, respectively. Shares have dropped seven consecutive days, a slide that has taken wiped out some $150 billion in market value.

Getting booted out of the S&P 500 is a mark of shame most companies try to avoid. But it's a harsh possibility several face.

The Bill & Melinda Gates Foundation Trust bought $96 million worth of AB InBev during the Bud Light boycotts, and received more Berkshire Hathaway.

After ripping through June, AI stocks haven't bounced much during quarterly earnings to end the summer.

In the U.S., the full retirement age for Social Security benefits has been incrementally adjusted based on a person's birth year, now reaching 67 for those born in 1960 or later. But many people continue to work well beyond this age. According to data from the U.S. Census Bureau, about 650,000 Americans older than 80 were working last year, representing an 18% increase compared to a decade ago. Nearly 50% of those 650,000 Americans worked full time. Don't Miss: This REIT just teamed up with the

Acclaimed Hollywood A-lister Ryan Reynolds has proven himself to be more than just an entertainer, delving into the world of investments with remarkable success. Despite his humble admission of not being an investing wizard, Reynolds has accumulated millions of dollars through well-timed business bets in recent years. In a recent appearance on CNBC’s "Squawk Box", Reynolds discussed his latest investment venture: Canadian financial technology (fintech) company Nuvei. In a statement about his sta

I’m 77 years old and I requested my 401(k) fund administrator to prepare my RMD. I was told I do not have to withdraw my money if I am still employed. Please confirm if this in fact an IRS rule or that of the fund management company? -Bea That is correct, Bea. If you are […] The post Ask an Advisor: I’m 77 and Still Working. Is it True That I Don’t Have to Take RMDs? appeared first on SmartReads by SmartAsset.

Today's best CD rate is 6.00% from American 1 Credit Union, with available jumbo rates of 5.85% from One America Bank and 5.80% from both Finworth and All In Credit Union.

Flywheel Energy Storage Market to grow by USD 200.38 million from 2022 to 2027, Growth opportunities led by Active Power Solutions Ltd. and Amber Kinetics Inc. – Technavio – Yahoo Finance