jaanalisette

jaanalisette

Many people ask a fair question: what does Twilio Inc. (NYSE:TWLO) do? The Internet and telephony networks are very different. Twilio bridges the gap between the carriers and the Internet. Developers write software, and Twilio enables that software to interoperate with the highly specialized carrier ecosystem.

Have you ever sent an image via SMS or any other platform that spans the Internet and telephony? By doing all the heavy lifting in between, Twilio makes things like this possible. Also, Twilio does this highly effectively on a mass scale for businesses.

Companies communicate with customers through various apps and other channels, and Twilio enables high-quality interactive communication. Moreover, Twilio is a leader in this field, and a massive market exists globally. Twilio enables enterprises to reach their customers effectively and efficiently. Furthermore, Twilio should continue optimizing its services by implementing AI.

Some of Twilio’s most significant corporate customers include Uber, Lyft, Shopify, Airbnb, Dell, and many others (over 300,000 brands building with Twilio). While Twilio’s growth has slowed due to the transitory economic downturn, its revenue growth should re-accelerate. A more accessible monetary environment should enable companies to expand their budgets again, increasing revenues for Twilio.

Despite the effects of an economic slowdown, Twilio’s solid fundamentals remain intact. Meanwhile, Twilio’s market cap has melted due to the temporary economic downdraft, creating one of the most significant buying opportunities I’ve seen in a long time.

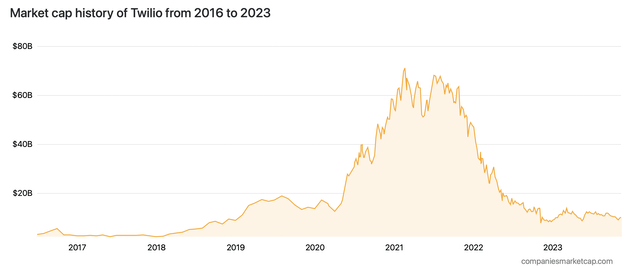

Market cap (Companiesmarketcap.com )

Market cap (Companiesmarketcap.com )

Twilio’s value was more than $70 billion, around the highs in 2020 and 2021. However, the economic slowdown caused excessive selling, bringing Twilio’s market cap down to just $10 billion, making its stock exceptionally cheap.

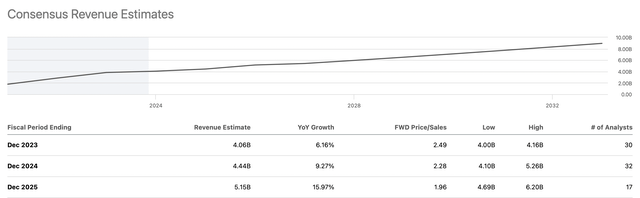

Revenue growth (SeekingAlpha.com )

Revenue growth (SeekingAlpha.com )

Twilio should achieve $5 billion in sales in 2024 or 2025. Yet, its market cap has shrunk to only $10B. When did you last see a high-quality software company selling at twice its revenues? For instance, Microsoft trades at ten times forward revenue estimates. Palantir trades at 15 times forward sales. Axon trades at nine times sales, and the list continues. The market is mispricing Twilio, and its stock price should go much higher in future years.

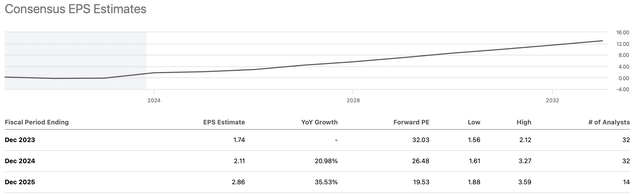

EPS estimates (SeekingAlpha.com)

EPS estimates (SeekingAlpha.com)

We should see robust EPS growth from Twilio. Next year, we could see EPS around $2, and we could see it at about $3 in 2025. This dynamic illustrates that Twilio is trading at only 18 times 2025 EPS estimates, which is remarkably cheap for a company in Twilio’s position, likely to continue growing revenues and EPS for many years as we advance.

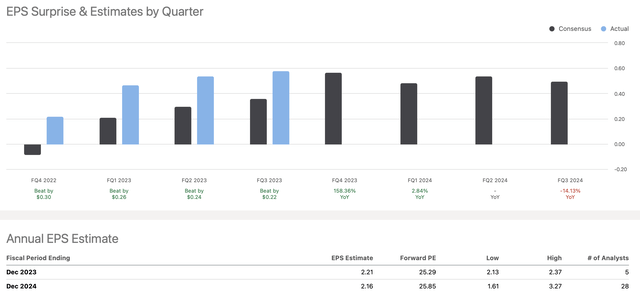

EPS vs. estimates (SeekingAlpha.com )

EPS vs. estimates (SeekingAlpha.com )

Twilio delivered $1.81 in EPS in its TTM. However, consensus estimates were for just 79 cents. We see a remarkable 130% beat rate, and Twilio should continue surpassing consensus figures as we advance. Twilio’s forward twelve-month estimates are $2.09, but the company can do much better.

Twilio just reported 58 cents in EPS relative to its 36-cent estimate, once again demonstrating a substantial beat rate of 61%. Twilio’s revenues beat by $40M, increasing by 4.8% YoY. Despite the considerable slowdown process, Twilio’s revenues continue growing YoY. Twilio’s organic revenues increased by 8% YoY.

Twilio’s data and applications revenue increased by 9% YoY. Twilio highlighted its 306,000 active customer accounts, a 9% YoY increase. Twilio also provided upbeat guidance, implying its growth could continue to outperform.

TWLO (StockCahrts.com)

TWLO (StockCahrts.com)

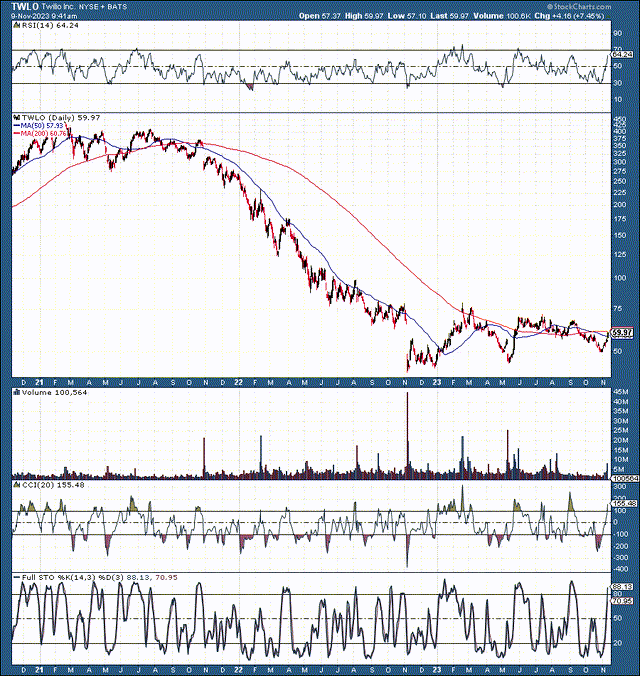

Twilio was in a bear market for a long time, and the stock dropped by a staggering 90% from its peak. However, fundamentally, nothing is wrong with its business. On the contrary, everything seems well, and the stock has been victimized for no apparent reason. The market is slowly recognizing the value here, and the effect could accelerate soon.

We’ve seen sideways price action during this long-term consolidation phase. Now, we have the 50-day MA crossing and going above the 200-day MA. This dynamic implies that Twilio’s stock price has been depressed for too long, momentum is improving, and it could go much higher soon. Due to its highly compressed valuation, once Twilio breaks out above the $70-75 range, it can quickly move up to $100 and then higher.

Revenue growth

Source: The Financial Prophet.

I used modest revenue growth and EPS growth projections. Also, I used a relatively low P/E ratio of below 30. Twilio could generate more robust revenue growth, leading to higher-than-anticipated profitability. Moreover, Twilio’s EPS growth could be above 20% for several years. Also, we may see Twilio’s forward P/E ratio shoot above 30 in future years. A higher multiple could result in a significantly higher stock price than my model suggests.

Twilio faces risks due to a slow macro environment, sluggish growth in its segment, high interest rates, persistent completion, and other factors. Due to the headwinds, Twilio’s growth may be slower than anticipated. Moreover, Twilio’s profitability growth may be worse than expected due to a sluggish economy, margin compression, and other factors. Also, Twilio’s multiple could remain depressed around the 20 range or lower in a bearish case outcome. Investors should examine these and other risks before investing in Twilio.

Are You Getting The Returns You Want?

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!

This article was written by

Victor Dergunov is an independent investor and author with 20 years experience. He preaches diversification and shares investment ideas across all market sectors. Victor aims to help readers build portfolios that perform well in all economic conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TWLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a long diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.